AppIntelligence® Score

The AppIntelligence Score from First American® Data & Analytics is an enterprise-level mortgage risk management solution that uses cutting edge, advanced decisioning technologies to deliver a highly accurate score and the truest picture of fraud and early payment default risk.

Innovative Analytic Technology Mortgage Professionals Can Trust

AppIntelligence Score pairs a comprehensive score-based model with real-time alerts cleared by underwriters which is then fed back into the model. This combination of artificial and natural intelligence generates highly accurate fraud and default scores that identify the most at-risk loans. Lenders dealing with a high volume of applications can easily streamline loan approvals, reduce manual reviews, mitigate risk and lower overall costs.

AppIntelligence Scores Account for a

Variety of Risk Factors

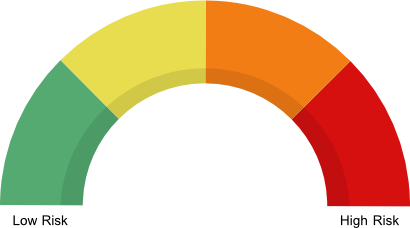

Using the AppIntelligence Score, a lender could prevent over 50% of fraud in the highest fraud score range and over 40% of early default and foreclosure in the highest default score range.

Innovative Technology Built the First American Way

First American Data & Analytics’ solutions have been awarded over 20 patents for title automation, loan risk assessment, online platforms, optical character recognition and data extraction. Using proprietary document data extraction technology, First American collects, extracts and curates the industry’s most robust and highest quality property-related data, such as mortgages, deeds, assignments, liens, fraud, etc.