The housing market contributes between 15-18% of the U.S. GDP, and may be vulnerable to the economic fallout from COVID-19. How vulnerable is housing to global pandemics? This report looks at the housing market immediately prior to, during, and after global pandemics and periods of economic shock. We will analyze the Severe Acute Respiratory Syndrome (SARS) and Swine Flu outbreaks, as well as the period after the terrorist attacks on 9/11, to see their impact on home sales and pricing trends. Analyzing this data may give us insights about whether these historical trends are predictive of how the housing market may react to the COVID-19 outbreak.

The COVID-19 Virus

Declared a global pandemic by the World Health Organization (WHO) on March 11, 2020, COVID-19 has wreaked havoc on the world’s economy since being discovered in Wuhan, China in December 2019.

China reported that over 5 million people lost their jobs over the first two months of 2020, as the country’s economy skidded into a recession. The European Union and the Eurozone are both expected to fall into a recession, while Italy, France, and Spain deployed country-wide lockdowns in an attempt to slow the spread of the virus.

Closer to home, President Trump declared a State of Emergency on March 13th, freeing up over $50 billion in federal aid. Congress passed an unprecedented $2 trillion economic stimulus package, even as first-time unemployment claims set a record by surpassing 3.25 million on March 26. The Trump Administration has also announced the suspension of all foreclosures and evictions for all mortgages backed by the U.S. Department of Housing (HUD) and the Federal Housing Finance Agency (FHFA), which is the conservator of both Fannie Mae and Freddie Mac, for at least the next 60 days. This action is attempting to alleviate concerns over the thousands of Americans who have been laid off, furloughed, or had their income dramatically reduced due to Federal, State, and Local Government initiatives that have closed businesses and prohibited social gatherings in an attempt to limit the number of the spread of COVID-19.

Severe Acute Respiratory Syndrome (SARS) – February 2003-July 2003

SARS, like COVID-19, is caused by a type of coronavirus. SARS was discovered in the Guangdong Province of Southern China in November 2002 and declared a global pandemic in February of 2003. Ultimately, SARS affected 26 countries and resulted in more than 8,000 cases in 2003. In addition to China, other countries with a high incidence of exposure included Hong Kong, Taipei, Singapore, Vietnam, and Canada. The United States had only 8 reported cases of SARS, so the impact on the country’s economy and housing market was low.

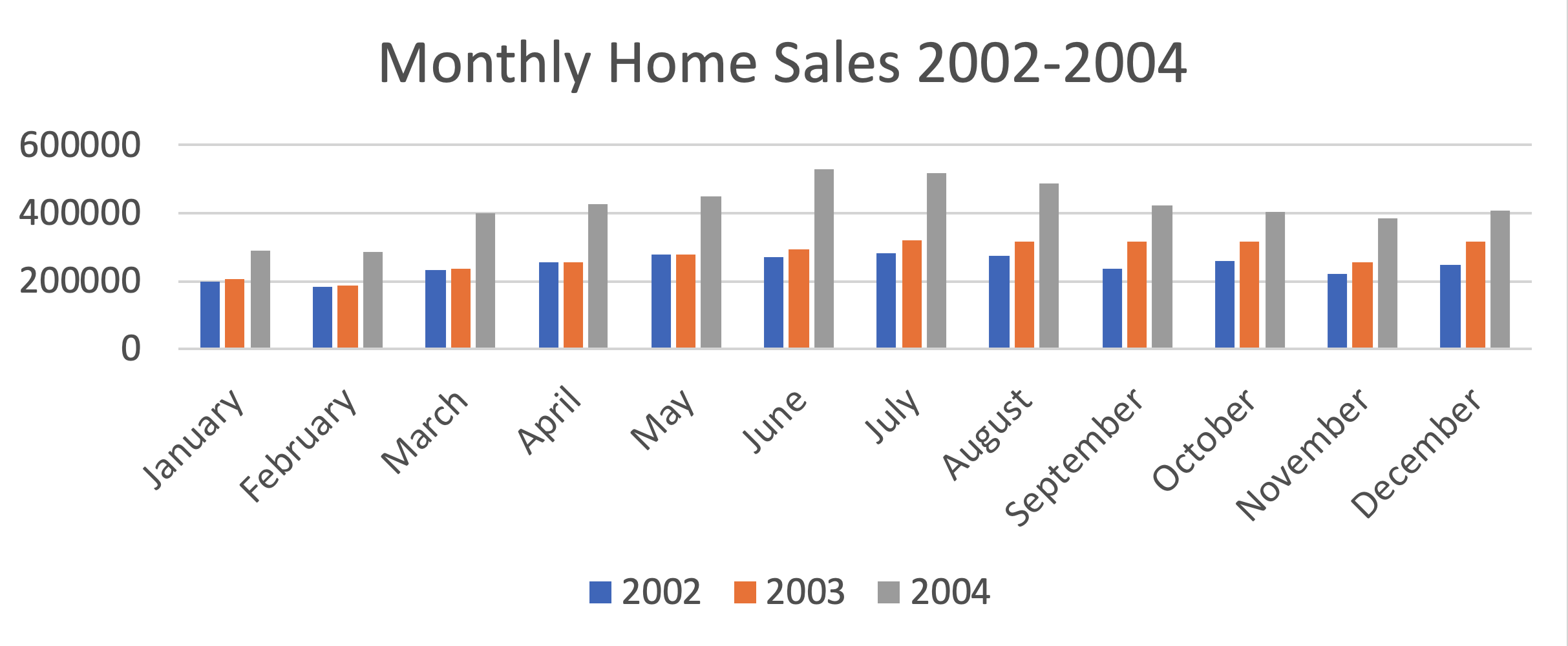

Source: First American DataTree®

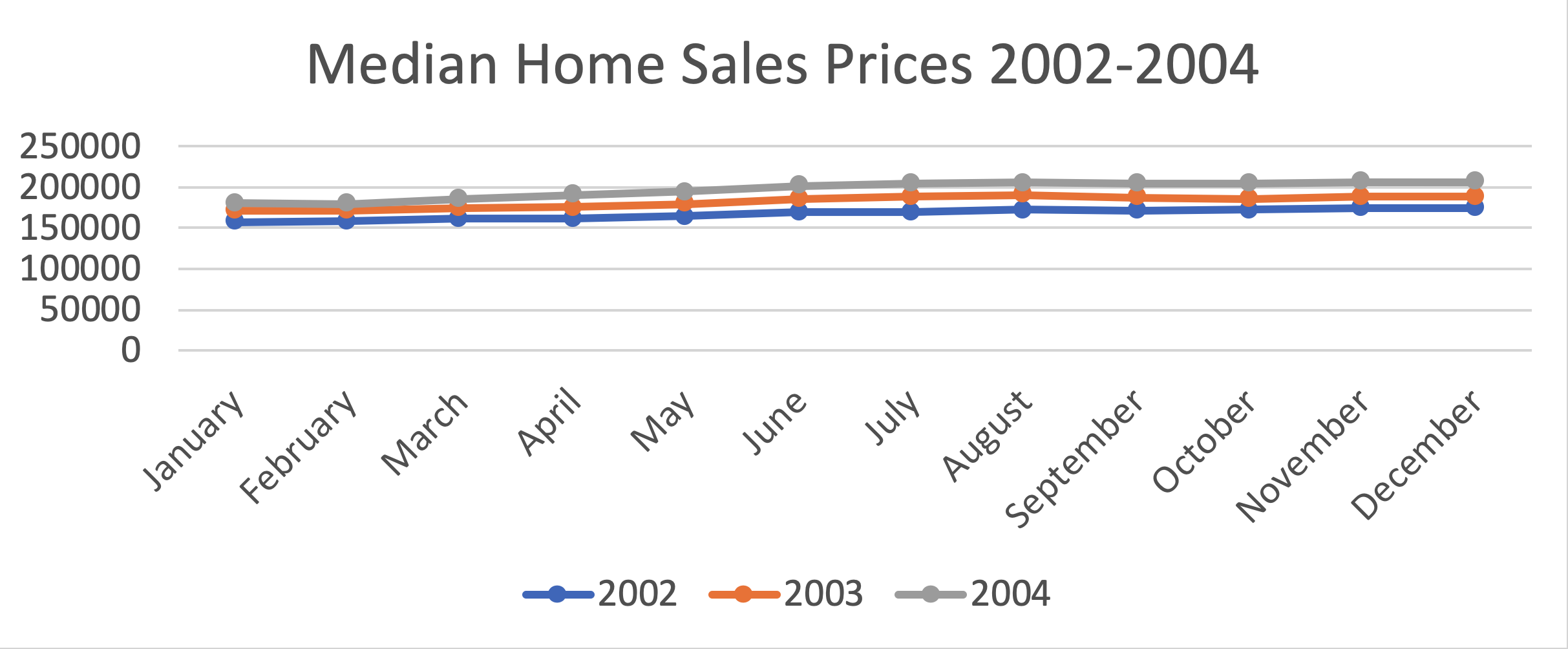

As illustrated in the chart above, home sales in 2003 increased compared to prior year sales in every month. The market growth increased towards the end of the year and continued to accelerate throughout 2004, as the U.S. entered a housing boom that would last another few years. Home prices, as detailed in the chart below, exhibited very similar seasonal patterns, but rose on a year-over-year basis for 24 consecutive months through 2003 and 2004. Median home sales prices moved from $157,000 to $206,500, for the period measured.

Source: First American DataTree®

Swine Flu (H1N1) – June 2009-June 2010

Unlike SARS, the Swine Flu had a measurable impact on the U.S. economy. Believed to have originated in Mexico, Swine Flu was first detected in the U.S. in April 2009. The WHO declared the influenza strain a global pandemic in June of the same year, when the disease had been confirmed in 70 countries and all 50 of the United States. The Center for Disease Control (CDC) estimated that by the time the disease was declared a pandemic, there were already over 1 million cases in the U.S. Between April 2009 and April 2010. In total, the CDC estimated that the Swine Flu infected almost 61 million Americans, resulting in over 273,000 hospitalizations and nearly 12,500 deaths.

While there is little doubt that H1N1 had an impact on the country, it’s less clear how much it affected U.S. home sales or prices. The country entered what subsequently would be known as “The Great Recession” in December of 2007, prior to the Swine Flu outbreak. The Great Recession was caused not by the pandemic, but by an epic meltdown in the mortgage market, and an unprecedented wave of foreclosure activity that followed. Home sales peaked in 2007, then plummeted over the next few years. It seems more likely that the recession, with unemployment rates approaching 10 percent, flat or negative wage growth, and limited availability of mortgage funding, had more to do with weakening home sales than H1N1.

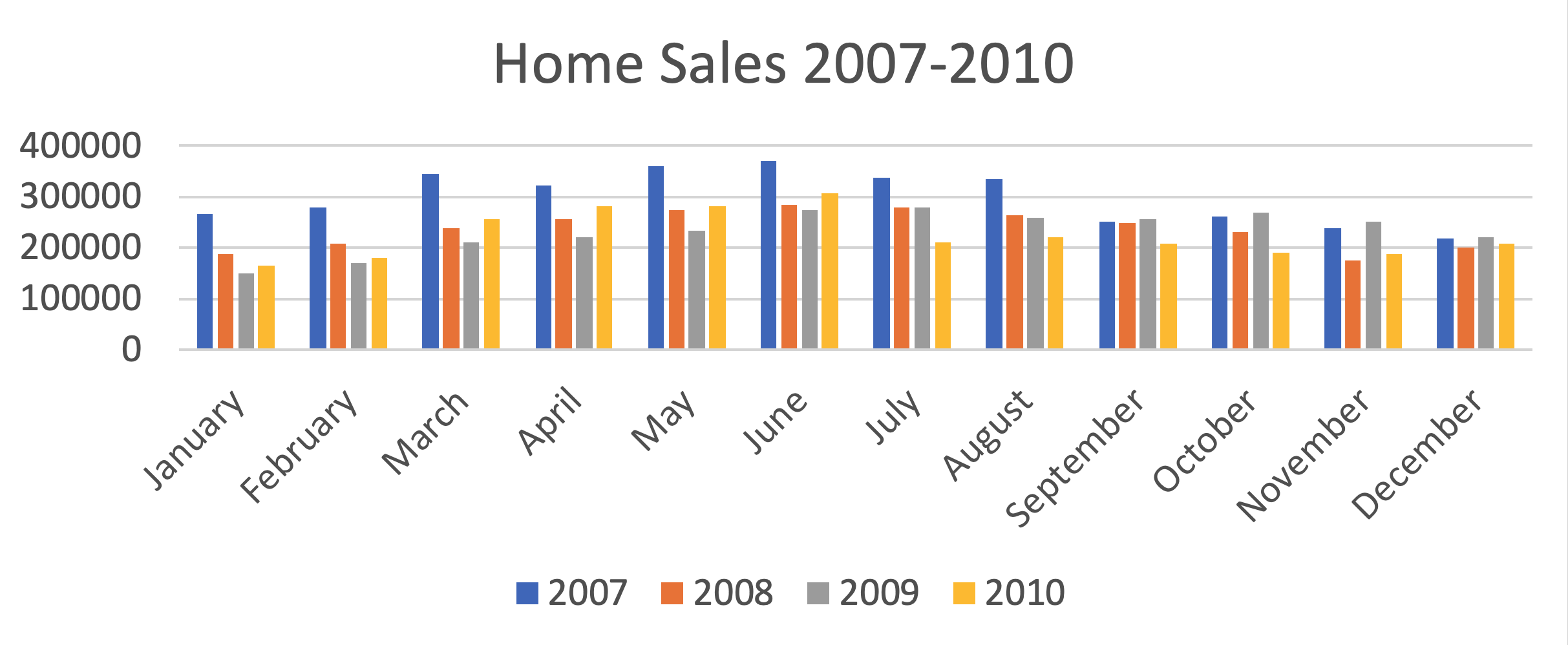

Source: First American DataTree®

It is worth noting that home sales over the first few months of 2009 – when Swine Flu infections were beginning to escalate – were the weakest of any set of months during the measured period. However, it is not obvious from the data that this pandemic, which had affected tens of millions of Americans, had any measurable negative impact on home sales or prices.

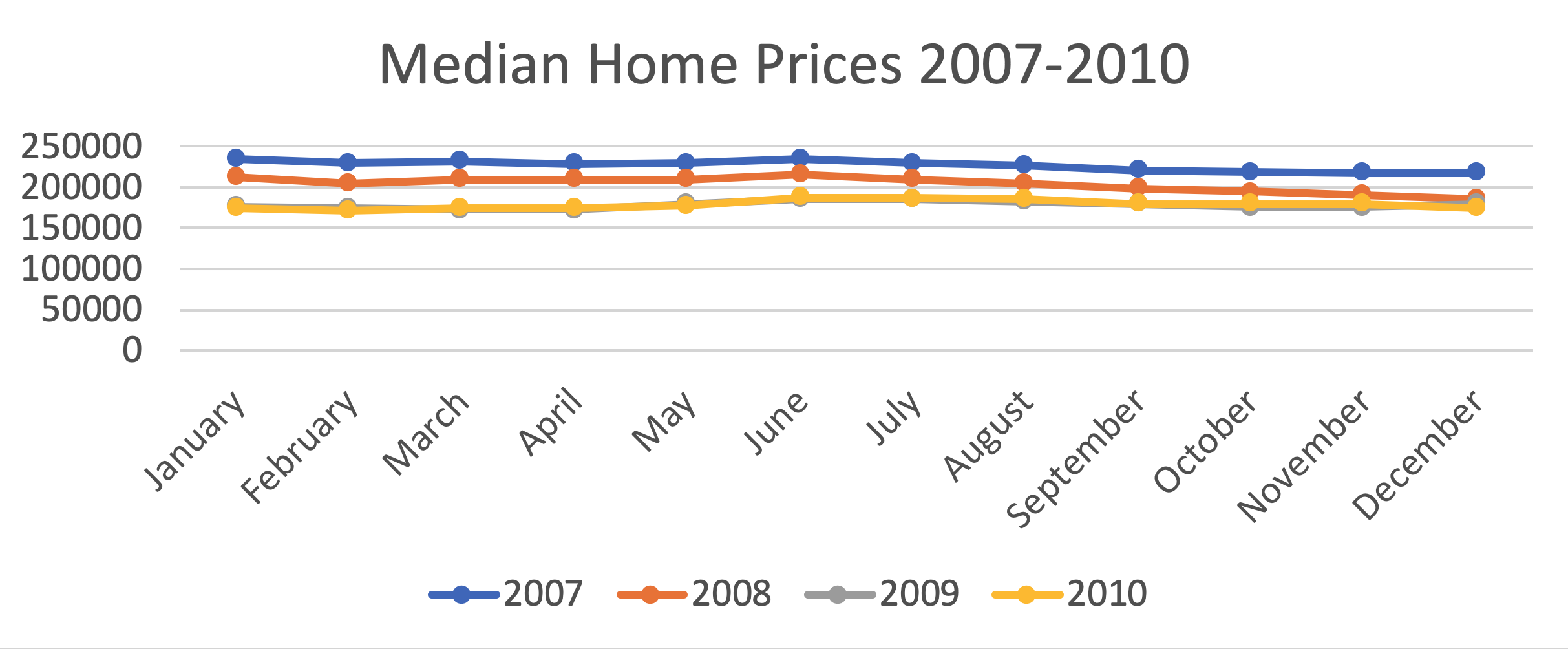

Home sales data from DataTree are virtually identical in 2008 (2.85 million homes sold) and 2009 (2.8 million) and only marginally lower in 2010 (2.7 million). Median home prices fell throughout the period, from a cyclical high of $235,000 in January 2007, but stabilized in 2009 and 2010 suggesting that the market was recovering along with the underlying economy in spite of the H1N1 pandemic.

Source: First American DataTree®

The apparent take-away from home sales and price data during and after the last two pandemics is that the housing market remained surprisingly stable and exited each period in no worse shape – and arguably in better shape – than when the pandemics began.

The Terrorist Attacks on 9/11

While the available data suggests that the housing market, unlike the stock market, remains relatively stable throughout global pandemics and seems to rebound quickly at the end of these events, the situation with COVID-19 is potentially more dire than what the housing market faced during the SARS and H1N1 pandemics. This is due in large part to the massive impact the virus is already having on the U.S. economy.

The virus has virtually shut down entire segments of the economy – travel, hospitality, sports and entertainment, restaurants, and “non-essential” retail operations – threatening the continued existence of countless businesses, and the financial well-being of hundreds of thousands of workers. Neither SARS nor H1N1 pandemics had that kind of economic impact. However, we have an event that might serve as a proxy of sorts: The terrorist attacks on 9/11/2001.

Like COVID-19, the terrorist attacks on 9/11 (and subsequent challenges, such as the Anthrax scare) brought the country to a virtual standstill and exacted an enormous financial and psychological toll on the entire country.

How did the housing market fare during and after this crisis?

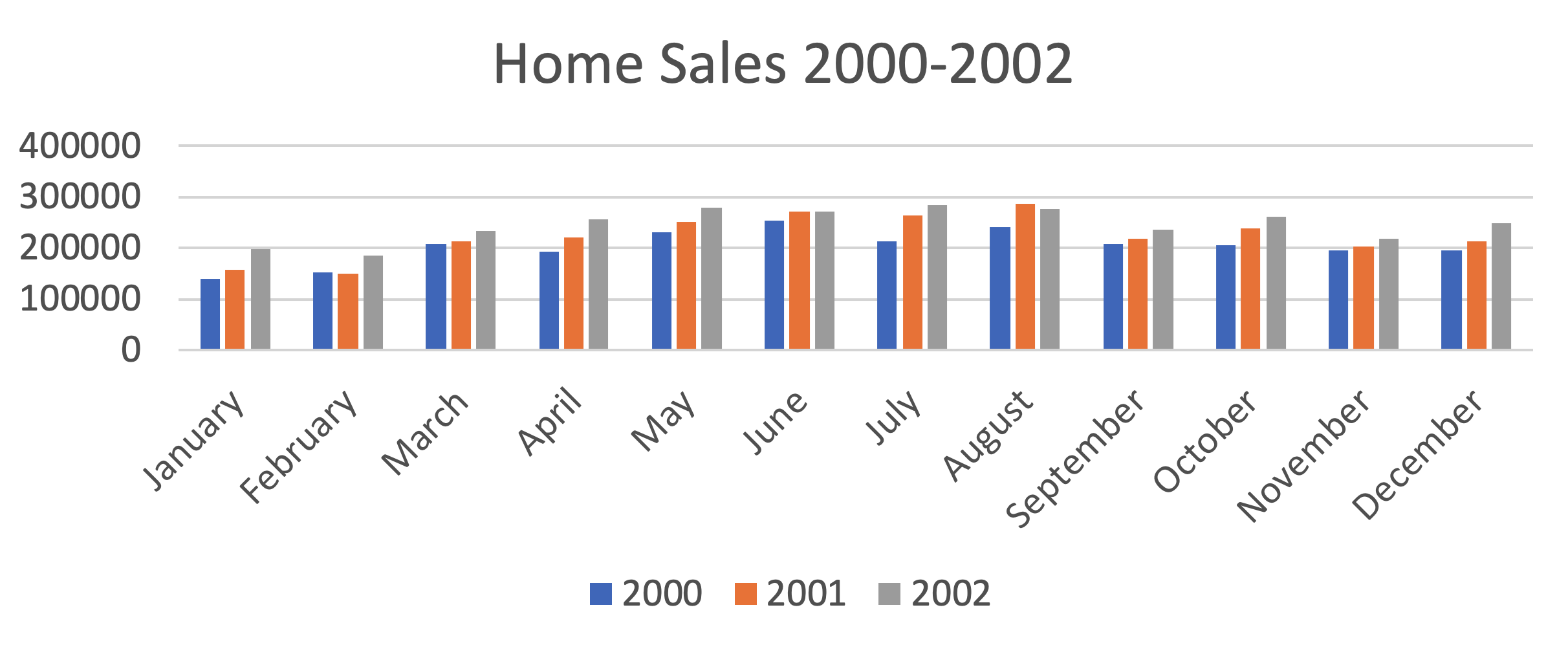

Source: First American DataTree®

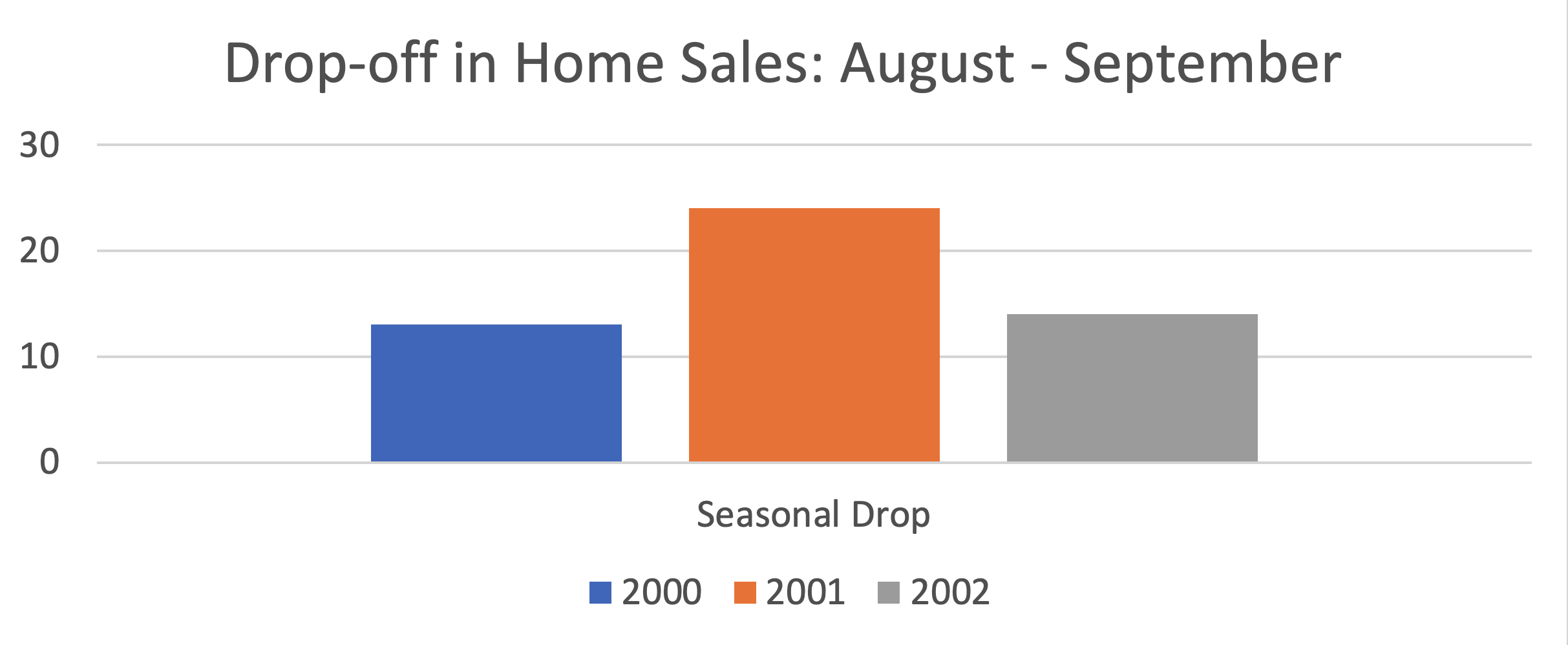

Home sales dipped in September – slightly more than the usual seasonal dip – following the attacks. By October 2001, sales had rebounded and continued a stretch that saw monthly sales increases on a year-over-year basis for 20 of the 21 months between March 2001 and December 2002.

Source: First American DataTree®

Source: First American DataTree®

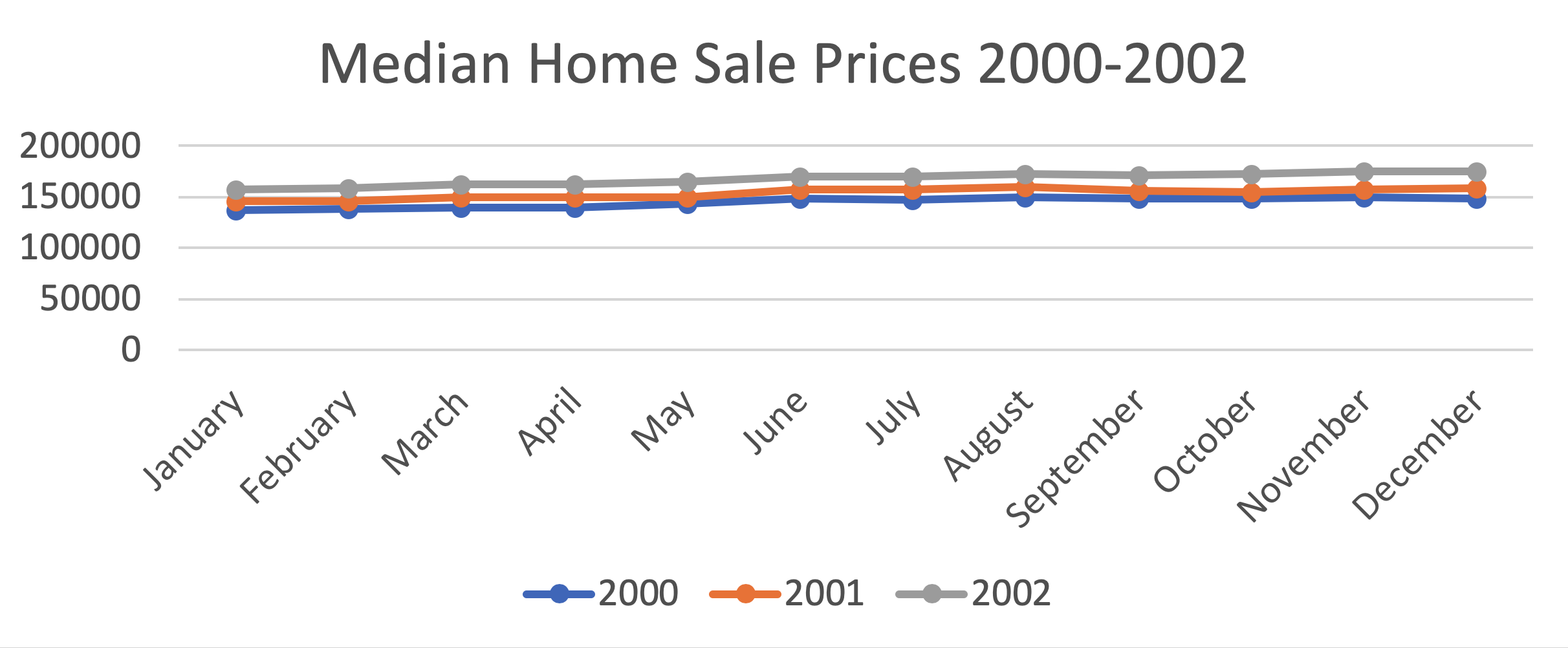

Home sales prices also held up, increasing on a year-over-year basis every month during 2001 and 2002 – even in September 2001, the month of the attacks. The rate of growth understandably slowed down during September and October 2001. Median prices rose during the period, from about $138,000 in January 2000 to $175,000 in December of 2002.

Implications for Today’s Market and COVID-19

The U.S. housing market has proven to be incredibly resilient in the face of recent pandemics, and the economic shock that followed the 9/11 terrorist attacks. Home sales and prices even grew during the U.S. recession from March 2001-November 2001. During periods where transaction volumes decreased, prices remained relatively stable, and ultimately increased.

The difficulty in using these prior events as a way to accurately predict the impact COVID-19 will have on the housing market is that none of them – SARS, H1N1, 9/11 or the 2001 recession – presented exactly the unique set of challenges that COVID-19 does. These recent pandemics did not spread as quickly nor caused governments to take the kind of drastic measures needed today in an effort to slow spreading, or “flatten the curve” of the number of infections.

The combination of the disease itself and the consequences of the short-term actions by government bodies make it difficult to predict what will happen to housing during and immediately after the pandemic. For instance:

- What affect will “social distancing” have on the inventory of homes for sale, which was already critically low? Will homeowners wait until the virus has subsided before listing their home for sale? If they list it, will potential buyers be willing to tour the home and risk infection?

- Will the impact of business closings push the country into a deep, long recession and put tens of thousands or hundreds of thousands of people out of work? What will the implications be in terms of demand?

- How many displaced workers will lose their homes to foreclosure – according to a recent study, 69% of Americans have less than $1,000 in savings and 33% live paycheck-to-paycheck. This indicates a higher likelihood that borrowers may default on their mortgage if they are out of work. If foreclosures are high, will we see home prices and homeowner equity fall disastrously as they did after the financial meltdown in 2008, creating another vicious cycle that creates more economic problems?

Before the COVID-19 virus became a factor, the housing market was strong. There was high demand, a record level of homeowner equity, historically low delinquency and default rates, and two consecutive months of huge year-over-year increases in housing starts providing hope that much-needed inventory was on the way. History suggests the housing market is likely to fare better through pandemics and recover more quickly than the overall economy or stock markets. Ultimately the fate of home sales and prices will be inextricably connected to how successful the country is at combatting the COVID-19 virus, and how many jobs are saved – and foreclosures prevented – by the economic stimulus programs deployed.