AppIntelligence Score is designed to help high volume lenders better identify fraud risk and potential early payment default in mortgage loan applications

Higher volume lenders need a better fraud monitoring tool that helps them streamline loan approval and focus their efforts on the loans at the highest risk for fraud.

AppIntelligence Score is an innovative, enterprise level fraud risk tool that uses artificial and natural intelligence (Ai+Ni), paired with smart analytics. This innovative technology is coupled with our proprietary fraud database, to uncover what factors are high contributors for fraud. The result is a highly accurate risk score that delivers the truest picture of where fraud and early payment default are most likely to occur.

AppIntelligence Score analyzes millions of alerts cleared by underwriters, feeding that information back into the model, making AI Score one of the most sophisticated models on the market.

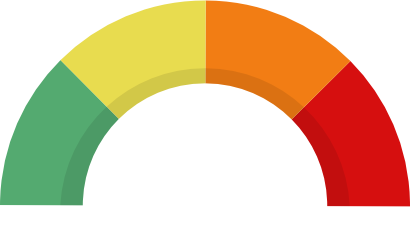

More than 50% of fraud and early payment default can be uncovered in just 10% of all loans

Work smarter, not harder. Reduce manual review targets from 50 percent to as low as reviewing 3 to 5 percent of applications that represent real risk.

Create high, medium and low risk swim lanes with dynamic reason codes, to expedite low risk loans for better pull through and more profitable underwriting.

Lenders can run the low-cost model instantly for pre-screening and pre-approvals.

Data-driven modeling score helps lenders identify previously undetectable risk, by creating score-based thresholds to predict potential EPD and fraud risk based on historical factors.