Solutions

Fraud & Loan Quality

FraudGuard®

FraudGuard® Home Equity

FraudGuard® Optional Modules

AppIntelligence® Score

AI Technology

CovenantGuard™

Home Equity

HELOC

Property Taxes

Taxsource

Title Analytics

VeriTitle

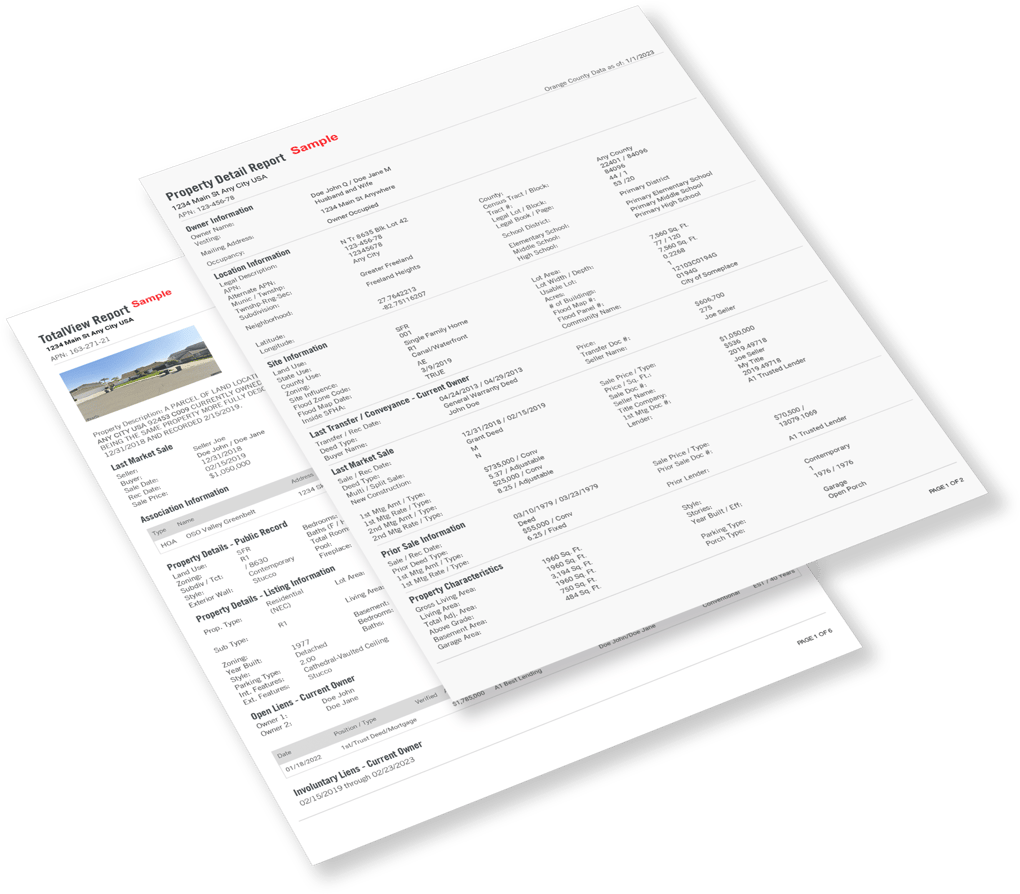

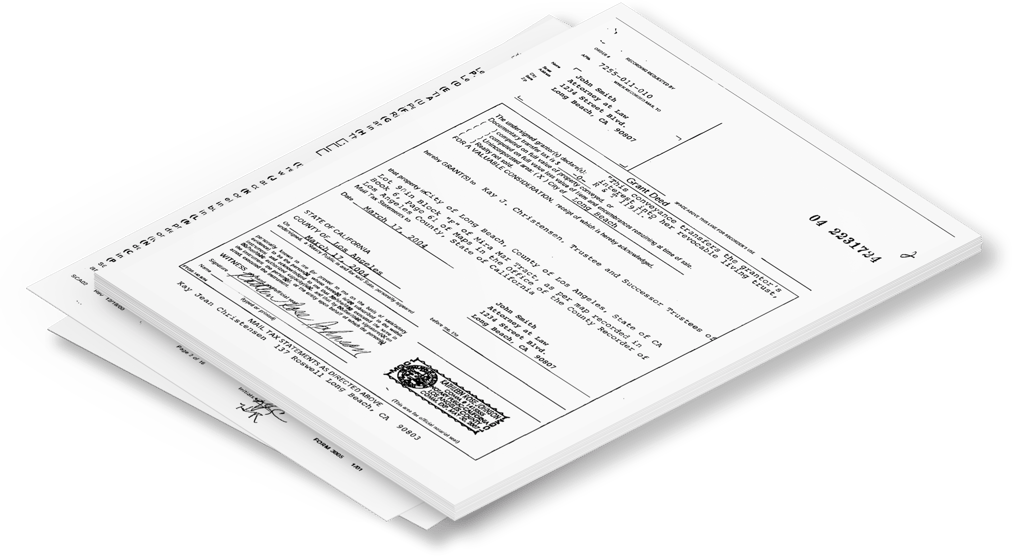

DataTree® Property Data Research

Our inclusive property research tool is fueled by trusted industry-leading data sets that span 100% of U.S. housing stock. Access only the property data you need, when and where you need it — saving you valuable time and resources. Click the button below or call us at 866.377.6639 to get started.

Start Free Trial

Recommended for more complex use cases or enterprise clients.

Recommended for more complex use cases or enterprise clients.